What could go wrong with consumer borrowings back to record levels and a Fed bent on boosting rates?

Coming out of the Great Recession, consumers scaled back spending to get their financial houses in order, and reduce their outstanding debt that was run up over the prior years. This was prompted in part by the shedding of jobs during the recession that put consumers in a financial bind, and it hit the economy in terms of tax receipts but also consumer spending. After several years of low to no wage growth, job creation that has skewed toward low wage jobs or part-time ones we’ve seen the average consumer ring up their debt levels back up to prior levels.

On its own higher debt levels will give way to higher interest payments, sapping disposable income and thus weighing on one of the key economic engines of the domestic economy. We also have a Fed that is near hell bent getting its monetary policy tools back in its toolbox and that includes boosting interest rates back to “normalized” levels. This means consumers are likely to face higher interest rates on their borrowings that will drive those interest payments higher and put a crimp in spending.

This tells us 2018 is poised to be another year of opportunity for our Cash-Strapped Consumer investing theme as consumers look to stretch as far as they can the dollars they do have to spend. The flip side of this investment opportunity is a headwind to the economy, one that can keep domestic GDP trapped in the 2%-2.5% range for yet another year. While we tend to poke holes in several Fed forecasts, even it sees GDP hovering near 2.0% in 2018 and 2019.

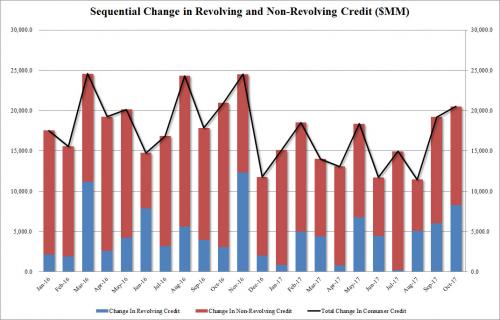

Total consumer credit rose by 6.5% Y/Y, rising to $3.802 trillion as of Oct 31. That number is more than double the rate of increase of US GDP or wage growth, making it clear just where America’s “purchasing power” comes from.

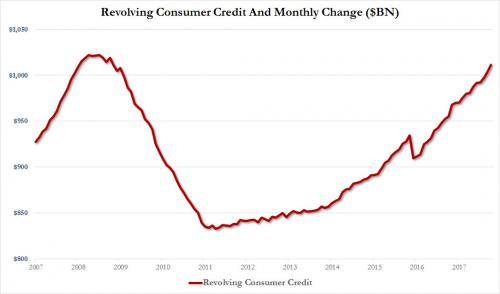

Finally, this was also the single biggest monthly increase in consumer credit since November 2016.And while nonrevolving credit reached a fresh record high of $2.791 trillion, revolving – or credit card debt – is now back well over a trillion dollars, or $1.011 trillion to be precise, and fast approaching the all time bubble high of $1.02 trillion hit in the summer of 2008.

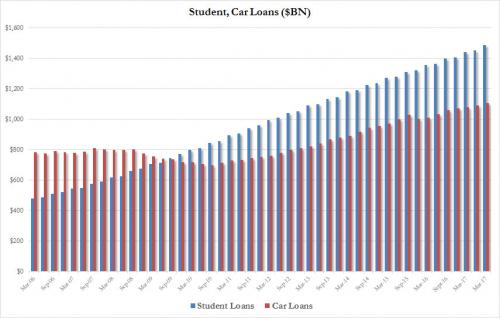

And speaking of student and auto loans, the Fed’s latest data showed that in the third quarter, these rose to a new all time high, of $1.108 trillion for auto loans, and a record $1.486 trillion in student loans. The Fed also reported that nonrevolving lending to consumers by the Federal government, which is mainly student loans, rose to $1.137t, on a non-seasonally adjusted basis.