What to expect in 2011

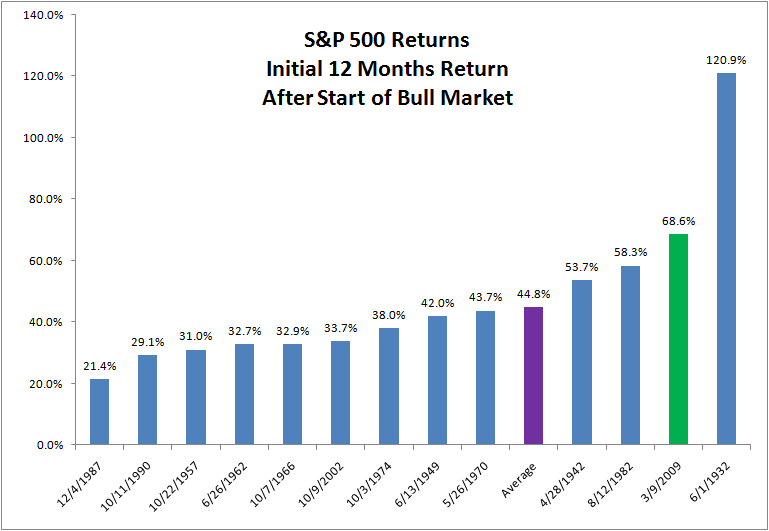

The current bull market began on March 9th, 2009, thus we are entering the third year of a bull market, which historically doesn’t perform all that well. The following chart shows the historical returns experienced in Year 1 of a bull market from 1932 to the present.

We experienced the second strongest market return in history in Year 1 of the current bull market, despite having questionable fundamentals such as enormous personal, corporate and sovereign debt as well unusually high unemployment. So perhaps some sanity returned in Year 2?

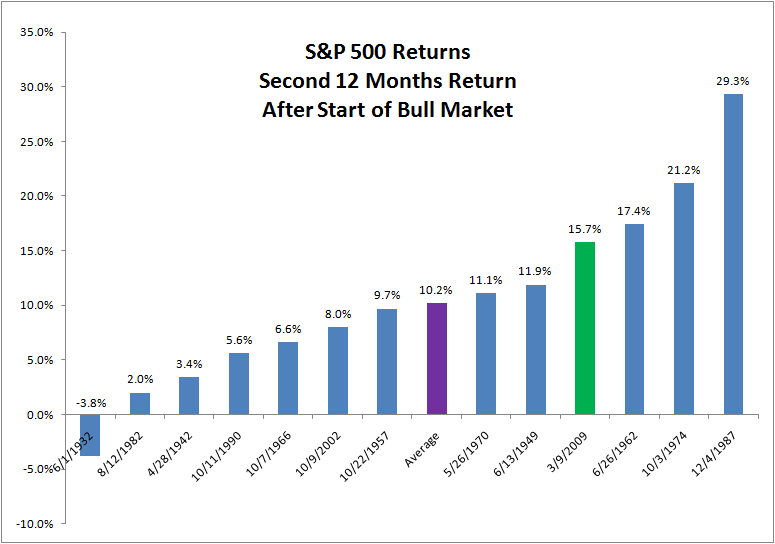

Doesn’t look like it. Year Two we had the fourth strongest returns in modern history. What is most striking, is that if we exclude the current bull market, the top three performers in Year One of a bull market were 1932 (best), 1982 (second best) and 1942 (third best). How did they perform in Year 2? 1932 was the worst. 1982 was the second worst and 1942 was the third worst. Don’t you just love the symmetry?

Doesn’t look like it. Year Two we had the fourth strongest returns in modern history. What is most striking, is that if we exclude the current bull market, the top three performers in Year One of a bull market were 1932 (best), 1982 (second best) and 1942 (third best). How did they perform in Year 2? 1932 was the worst. 1982 was the second worst and 1942 was the third worst. Don’t you just love the symmetry?

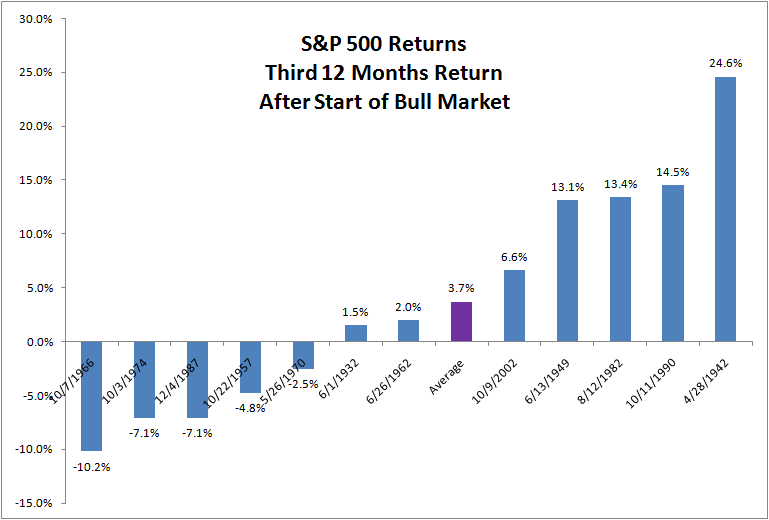

So what can we expect in Year Three?

50% of the bull markets experienced positive returns in three consecutive years, but never in one with such a strong 1st and 2nd year.

50% of the bull markets experienced positive returns in three consecutive years, but never in one with such a strong 1st and 2nd year.

| Start Date | 1st 12 Months | 2nd 12 Months | 3rd 12 Months |

| 4/28/1942 | 53.7% | 3.4% | 24.6% |

| 6/13/1949 | 42.0% | 11.9% | 13.1% |

| 6/26/1962 | 32.7% | 17.4% | 2.0% |

| 8/12/1982 | 58.3% | 2.0% | 13.4% |

| 10/11/1990 | 29.1% | 5.6% | 14.5% |

| 10/9/2002 | 33.7% | 8.0% | 6.6% |

While history doesn’t necessarily repeat itself, it is useful to look at historical trends. We see a mountain of fundamental problems building this year:

1. Instability in the Middle East and North Africa 2. Crisis in Japan… and its impact on already rising energy costs3. Problems with the Euro * Portugal’s Prime Minister submitted his resignation to the President on 3/23 * Austerity measures not being received well * Germany’s PPI increased 6.4% year over year in February (inflation?)

4. Food prices at all time highs. 5. Energy prices increasing.

6. U.S. Federal debt is 100% of GDP and once again Congress is looking to raise the debt ceiling. 7. Entitlement programs at the Federal and State level are unsustainable. 8. Inflation fears in China and India. 9. China’s real estate bubble? 10. U.S. housing market double-dip?

There’s more, but those are sufficient reasons for Year Three of this bull run to be challenging at best. Remember too that 2010 was in the grim negative territory until QE2 rode in on its white horse. Will the Fed pull another rabbit out of its hat? If so, what will be the longer-term consequences of yet more intervention?

In such a climate, a strategy that takes advantage of market volatility, rather than depending on a particular direction is more likely to provide financial stability and help promote restful nights.