Many focus on theFed not raising rates, we ask: why is it the Fed is backing off raising rates?

Last week, the stock market continued its move higher, shrugging off the weak February Retail Sales report from the start of the week that included a sharp revision lower in January Retail Sales as month over month improvements in the March Empire Manufacturing and Philly Fed indices offset the dip in February Industrial Production.

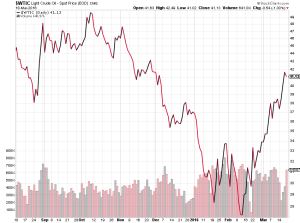

As helpful as those data points were in filling in between the lines of the shape of the domestic economy this quarter, the two real drivers of market last week were the expected “news” that the Federal Reserve left interest rates unchanged as expected exiting its March FOMC meeting, and the news that members of the Organization of the Petroleum Exporting Countries (OPEC) are planning to meet with Russian energy officials and other oil producers in Doha on April 17 to hash out an agreement to limit output. We’ve heard similar chatter over oil production cuts before, only to see the market over-anticipate what was to come. Given the bounce back in oil prices over the last several weeks, we suspect any production cuts to come from this meeting would be far smaller than when oil was below $30 per barrel.

The two drivers of the market move last week raise some good questions, even as they fueled another 1.3 percent rise in the S&P 500, which left index by the end of week modestly in the black on a year-to-date basis.

- First, the Fed’s unexpected lack of action raises questions over the tone of the economy — if the economy is improving as Washington says, then why can’t it absorb another modest boost to interest rates like the one in December? Yes, that is sarcasm you are hearing in our voices.

- Second, gas prices have already started to move higher in recent weeks, and with consumers already restrained in their spending (per the February Retail Sales report), how will shrinking big gas savings impact their willingness and ability to spend? Remember, the domestic economy is largely driven by consumers and services.

On the Fed’s not raising interest rates, this was hardly shock to those of us that have been paying attention to the economic data of late, which painted a picture of a slowing global economy as well as additional rounds of monetary policy stimulus outside the U.S. and the utter lack of inflation as evidenced by February Producer and Consumer Price Indices. Here’s the thing: Even by doing nothing — while other central banks like the European Central Bank, People’s Bank of China, Sweden and others have sprinkled more monetary policy fairy dust — the Fed is de facto tightening, simply because it is not matching the latest round of stimulus, a.k.a. loosening, around the world.

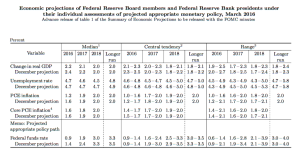

What we did find somewhat surprising in the Fed’s FOMC statement was the official ratcheting back of the expected number of rate hikes to two from four. It’s not that we expected four rate hikes this year, but rather that with nine months to go in 2016 the Fed has already thrown in the towel on its own December forecast. Peering into what the Fed’s now sees for the US economy, that towel throwing is easily understood: The Fed now sees U.S. GDP at 2.2 percent, down from 2.4 percent in December, and inflation running cooler than previously thought for 2016 at 1.2 percent vs. 1.6 percent. It also sees the U.S. economy slowing in 2017 and 2018 relative to 2016. This fits with the Fed’s commentary that was littered with the word “moderate.” Looking at the Fed’s other key focus area that is stable prices, inflation is not expected to hit the Fed’s 2 percent bogie until 2018. What all of this means is if the economy continues to bump along and the larger global economy remains challenging, we could see the Fed reduce the number of expected rate hikes from two to one to zero in coming months as more data become available.

Many will be focused on the Fed’s not raising rates, but our view-askew approach has us asking the following question: Why is it the Fed is backing off raising rates?

The answer is tied to the slowing pace of the global economy that we’ve witnessed and, in our view, concern over its ability to reignite in the back half of 2016. We’ve shared with subscribers of Tematica Investing and Tematica Pro our view that earnings expectations for the S&P 500 group of companies is overly robust in the second half of 2016, especially compared to the first half of the year, and we find the Fed’s economic forecast revisions to be a confirming take on that view.

Turning to the week ahead

We hope you enjoyed the relatively slow, and Fed-dominated news last week. The bad news is the velocity of economic data will pick up this week and it will do so in a compressed week given many stock markets, including those in the US, are shut for Good Friday. Seeing as how we are less than two weeks to the close of the current quarter, we view all that data as helpful in sharpening the view on how the economy performed during the three-month period.

We have a number of items on the economic calendar, including February housing data as well as the Durable Orders report for February, but it will be the Flash PMI reports that we will be drilling into next week. These reports will give us the first look at the economic tone for Japan, Eurozone and the US in March, as well as a first glimpse at how April is stacking up. As we close out the quarter, this will help fill in the missing puzzle pieces.

Apple to Make Some Noise on Monday

In case you haven’t head, Apple (AAPL) will hold its first event of 2016 on on Monday (April 21) and this poster child for the Connected Society investing theme is expected to launch several new products, but nothing quite as flashy as the Apple Watch. As tends to be the case, there is much Internet chatter over what the company is likely to introduce (a 4-inch iPhone SE, a new 9.7-inch iPad, a range of new Apple Watch bands, and software updates for iOS 9, watchOS 2, tvOS, and OS X El Capitan), but Apple tends to surprise. Sometimes those surprises are big, sometimes they are small, but either way it will be an event that will likely shape the next iteration of Connected Society devices to come in 2016.

Thematic Earnings We’ll Be Watching

With just under two weeks until the close of the current quarter, we continue to see another leg down in the number of companies reporting their quarterly results. On the one hand, that means far fewer press releases and conference calls to listen to, but on the other it means what data points we get are likely to sway investors more than during the earnings frenzy we had a few weeks ago.

It also means we will be on the lookout for companies that pre-announce their March quarter results, which more often than not mean a shortfall relative to expectations. Such actions were taken by both heavy equipment company Caterpillar (CAT) and Chipotle Mexican Grill (CMG) this past week, neither of which was surprising given the tone of the global economy and the mining industry, and for Chipotle, the impact had by E. coli outbreaks on its store traffic. Be sure to check your mailboxes for all free burrito coupons from Chipotle, and if you’re not going to use them or are contemplating throwing them out, feel free to send them to us – the mailing address is down at the bottom.

Here are the corporate earnings reports that have caught our thematic eye this week:

- Affordable Luxury: Nike (NKE), PVH Corp. (PVH), Finish Line (FINL), Signet Jewelers (SIG)

- Cash Strapped Consumer: Five Below (FIVE), Fred’s (FRED), General Mills (GIS)

- Cashless Consumption: On Track Innovations (OTIV), Payment Data Systems (PYDS)

- Connected Society: Sigma Designs (SIGM)

- Content is King: GameStop (GME),

- Economic Acceleration/Deceleration: Blount International (BLT)

- Fattening of the Population: Krispy Kreme Donuts (KKD)

- Foods with Integrity: The Fresh Market (TFM)

- Rise & Fall of the Middle Class: Iconix Brands (ICON), Jarden Corp. (JAH),

- Safety & Security: Elbit Systems (ESLT)

- Scarce Resources: Connecticut Water Service (CTWS)

Talking Fed Heads Making the Rounds

In addition to the usual flow of economic data and corporate commentary, we are getting a number of Fed heads making the rounds at conferences and other events this week. We should expect to hear more about the Fed’s decision last week, but if you’re hoping for more clarity on when the Fed will indeed boost interest rates… you probably have better things to do than listen to Richmond Fed President Jeffrey Lacker, Atlanta Fed President Dennis Lockhart, and Philadelphia Fed President Patrick Harker this week. While the Fed meets in April, the next FOMC meeting to watch in terms of a rate hike will be June and that means we’ll be paying attention to the global economic data between now and then.

More Caucuses and a Primary, but No Republican Debate

On the political front, we have caucuses in Utah and Idaho as well as Alaska, Hawaii and Washington this week not to mention Arizona’s Primary. There is no Republican debate this week, and while we can argue about how good or bad that may be, I think we can pretty much agree that the law of diminishing marginal returns characterizes the last few of those debates. Also sure to make some political headlines, President Obama visits Cuba, while we hear more on Apple vs. the FBI.

What’s Next

Tematica Investing subscribers will receive our latest thoughts, comments and analysis on Wednesday, while Tematica Pro will get similar commentary, but for the expanded long, short, and option universe on Thursday. As always, should the need to take action, good or bad, arise, special alerts will be issued.

Enjoy your week as well as the upcoming long weekend!

ECONOMIC CALENDAR, MARCH 21 – 25, 2016 |

||

| DATE | REPORT / SPEECH | DATA |

| 21-Mar | Existing Home Sales | Feb |

| 22-Mar | FHFA Housing Price Index | Jan |

| 23-Mar | MBA Mortgage Index | 19-Mar |

| 23-Mar | New Home Sales | Feb |

| 23-Mar | Crude Inventories | 19-Mar |

| 24-Mar | Initial Claims | 19-Mar |

| 24-Mar | Continuing Claims | 12-Mar |

| 24-Mar | Durable Orders | Feb |

| 24-Mar | Natural Gas Inventories | 19-Mar |

| 25-Mar | GDP – Third Estimate | Q4 |

| 25-Mar | GDP Deflator – Third Estimate | Q4 |