Why S&P 500 EPS expectations showcase the need for thematic investing

Over the last few weeks as all of have been dealing with the pandemic and its impact on our daily lives, we’ve seen a number of changes unfold that are and will continue to reverberate through our lives, business models and investor expectations. The down and dirty has me thinking that thematic investing is timelier than ever and in the paragraphs below I walk through not only why that is but a solution that we think many investors will find appealing provided we can nail things down

More to come, but for now, enjoy and stay tuned.

- The Stock Market Rallies Even As 2020 Earnings Expectations Crater

- The Proof Is In The Thematic Investing Pudding

- What’s Ahead

The Stock Market Rallies Even As 2020 Earnings Expectations Crater

Last week we closed the book so to speak on May and this week we entered the month of June, the last one of the three that form the second quarter of 2020. During May, all of the major US equity indices continued to regain ground that was lost in February and March owing to the spread and impact of the COVID-19 pandemic. The magnitude of May’s gains was smaller than those in April when all four major market indices rebounded 11%-15.4% vs. following the coronavirus inspired gut-punch in February and March. The market’s move higher in April was spearheaded by the Fed’s latest round of monetary stimulus as well as unprecedented levels of federal stimulus, a pretty effective stock market prescription by anyone’s reckoning. The market’s sequential increase in May reflected the switch from pandemic pain to hopium tied to the re-opening of the global economy. Those expectations, however, were tempered late in the month by renewed US-China tensions that culminated with President Trump’s press conference announcing the US would withdraw its financial support from the World Health Organization and eliminate the US’s special treatment of Hong Kong in a move to hit back at China, following its plans to impose greater control over Hong Kong. Also weighing on the end of May, was the growing number of protests around the US that have created yet another setback for retailers, restaurants, and other businesses.

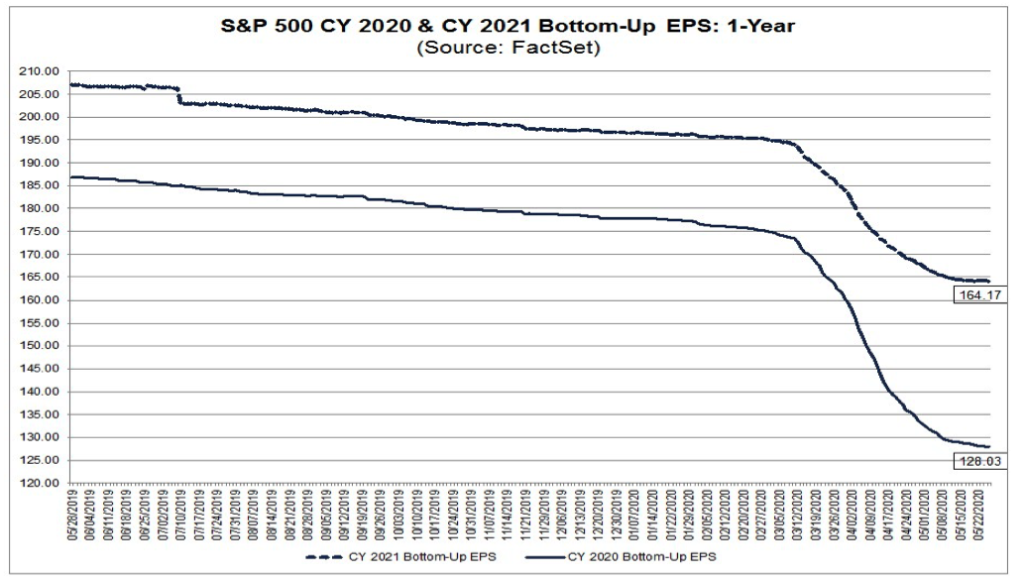

Even as much of the stock market has recovered, with the S&P 500 down just 5.8% at the close of May, earnings expectations for the S&P 500 moved dramatically lower compared to pre-COVID-19 expectations. At the start of 2020, the consensus EPS forecast for the S&P 500 was $177.77, up from $162.35 in 2019, which at the time reflected continued global growth and benefits associated with the inking of the US-China phase one trade resolution in late 2019. Over the ensuing weeks, however, the coronavirus reared its head and led the Chinese economy in a downward spiral, reducing demand and weighing on companies with meaningful exposure to that geography.

As we all know, several weeks later the outbreak spread to Europe, hitting Italy especially hard, and before too long forced the US economy into lockdown in early March. In the past two months, a growing list of companies pulled their 2020 guidance and the expectation is the economic impact from the pandemic will be far greater in the June quarter even though states in the US are starting to open their economies on a phased approach. No surprise given the pandemic largely hit the US and Europe partway into March, having a smaller impact compared to what it would have on those economies during April and May. The coming weeks will bring us the May’s economic data that will help fill in the blanks on the economy’s vector and velocity as well as provide some signs for how it may fare this month. While we are hopeful for some degree of sequential improvement relative to April, we should recognize the May data will likely be comparatively worse than that for March. The May ISM Manufacturing Index bore that view out as the headline index recovered to 43.1 from 41.5 in April but as expected came in well below March’s 49.1 reading. On a positive note, the order component of the May ISM manufacturing index rebounded to 31.8 from April’s 27.1, but it also suggests a slow recovery given the distance to the March order reading of 42.2 and February’s 49.8. The May Caixin China General Manufacturing PMI returned to expansion territory, hitting 50.7 up from April’s 49.4 reading, however, demand conditions remained subdued as new work declined in May due to a “notable fall in export orders.” That logically reflects the May impact of the pandemic felt in the US and Europe, which only began to re-open toward the end of the month.

Exiting May, the pandemic expectation hatchet left 2020 EPS for the S&P 500 at roughly $128 per share, down almost 28% from where it entered the year. Cleaving into that expectation, it’s predicated on the collective earnings from the S&P 500 rebounding 21% in the second half of the year. While I would hate to throw a wet blanket on things, the jury is still out on how quickly the consumer, you know THE primary economic engine in the US, will return to pre-COVID spending habits. With roughly 40 million filing for new initial jobless claims over the last ten weeks and the April Personal Income & Spending report revealing wages & salaries declined 8% following March’s 3.5% fall off, I would argue it’s a safe assumption that we are not looking at a V-shaped recovery in consumer spending despite the likely build-up of pent-up demand. For example, it’s being reported that Starbucks (SBUX) will “limit employee hours to match pared-back operations at its U.S. stores” because it doesn’t expect sales to return to pre-COVID-10 levels until “the fall.” My thinking is if Starbucks is having a rough go of it, there will be others…

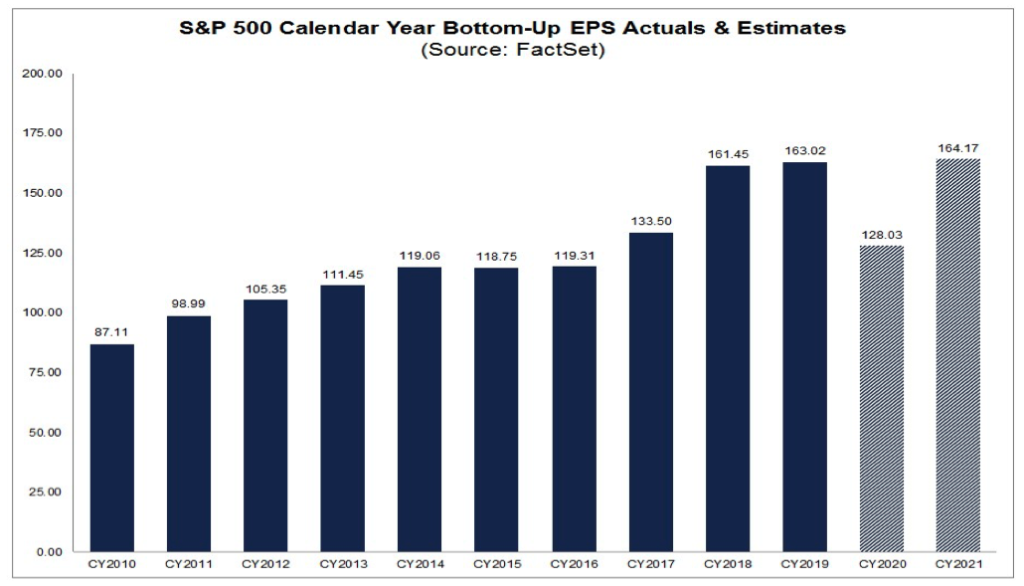

When asked on TV, cable, and streaming financial shows how I’m valuing the market, my answer has been to focus on 2021 when hopefully the pandemic will be less of a factor. At first blush, some would quickly point out how the consensus view has the S&P 500 rising some 28% year over year in 2021. Wow! But when we get some much-needed context, like that offered in the above chart, we see EPS growth for the S&P 500 is largely flat over the 2018-2021 period.

If we accept the long-touted truth that profit growth is the mother’s milk for stock prices, where are investors to turn?

The Proof Is In The Thematic Investing Pudding

Let’s come at that from a somewhat different angle, after all, much can be realized by changing one’s perspective… adopting a “view askew” if you will. I’ve talked quite a bit over the years about the power of thematic investing and to keep it somewhat simple, when done properly, thematic investing identifies structural changes that result from the shifting landscapes of economics, demographics, psychographics, technology, and regulatory mandates. There are other forces as well but those are the main ones that lead to a change in consumer or business behavior that challenges the existing paradigm. Some companies change their business model, while others try to and some let’s be honest don’t even see it coming. Those that are successful ride the tailwinds of that structural change, which drives revenue and EPS growth as well as cashflow.

So much for being brief, but let’s see if we can connect all of those dots into a short summary. Thematic investing when done right identifies alpha. And for those that may not be as familiar with the hedge fund lingo I just busted out, per Investopedia, alpha measures the amount that the investment has returned in comparison to the market index or other broad benchmark that it is compared against. In other words, alpha measures just how much an investment outperformed its benchmark which in this case is the broad market.

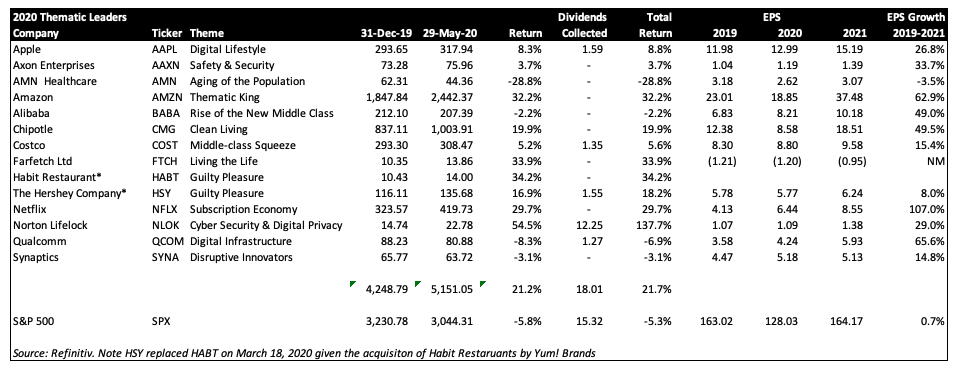

I realize that all sounds pretty good, but the section head says “The Proof Is In The Thematic Investing Pudding” so how about we provide some pudding? Good idea, and let’s do it in a simple table:

The first reaction (more than likely) is, what is that?

When we formed Tematica, we did so in part to house the Tematica Investing newsletter but also to do more with the thematic framework and ultimately the Thematic Scorecard that we developed. And we’ve done just that, using the Scorecard to power the Tematica Research Dividend All-Stars Index and the Tematica Research Cleaner Living Index as well as the RizeETF Cybersecurity & Data Privacy UCITS ETF (CYBR) that trades in Europe and is powered by the Foxberry Tematica Research Cybersecurity and Data Privacy Index.

That’s great Chris, but let’s get to that table…

Right… right… sorry about that… where was I? Oh yes, so while we had the newsletter, I also developed a set of thematic models, and each year I would select those best thematically positioned for the coming year. What you see above is what I refer to as the Thematic Leaders. In 2019, a year in which the S&P 500 returned 28.9% before dividends, the Thematic Leaders returned 42.7%. So far this year, the 2020 crop of Thematic Leaders are up 22.1% through the first five months of the year, well ahead of all the major market indices. When we look at earnings growth for the Thematic Leaders over the 2019-2021 period, it dwarfs the less than 1% EPS growth expected for the S&P 500 over that time frame. And since we’re all friends here, I will share that I look forward to making a rare addition to the Thematic Leaders in July when we debut our next investing theme. Much like all of our other themes, it too will identify a multi-layered structural theme that we see playing out over several years – trust me when I say it won’t be a fad or a trend that will vanish almost as quickly as it came about.

Ever since we wound down the Thematic Investing Newsletter, I’ve had past subscribers reach out and ask if we were going to restart the newsletter… While it is tempting, we are slated to have another ETF launch during the summer and we are working hard at converting some of our other themes into indices and related products.

Would you be open to licensing your models, including the Thematic Leaders?

Now that is an interesting question… the nature of the models resonates with the longer-term nature of thematic investing and removes some of the day to day noise that folks can get wrapped up in. To do it right, the models would update for something dramatic, like if one of the Leaders was acquired. We saw that happened this past March when Yum Brands! (YUM) closed its acquisition of Guilty Pleasure Thematic Leader Habit Restaurants for $14 per share – well ahead of the $10.43 share price it had entering 2020. We filled the slot with shares of The Hershey Company (HSY), which we picked up at a sweet price as a result of the pandemic. According to data published by Flavorchem, a company that specializes in the creation and manufacturing of flavor and color solutions for the food, beverage, and nutraceutical industries, 79% of consumers have admitted to purchasing more comfort food now than in previous months before the COVID-19 pandemic. Among Flavorchem’s findings, what jumped out at me was chocolate being the top quarantine snack, with 90% of shoppers purchasing some form of this treat in the last three months. I’m no stranger to chocolate, far from it actually, but this high attach rate for consumer grocery shopping along with Hershey’s pivoting of its snacking portfolio toward healthier alternatives offers the right mix of for all kinds of consumers.

I would also reserve the right to make changes to the Leaders if there was a meaningful change relative to the reasons why a company was elected to the leaderboard. While such action could come from a management change, product or business divestiture or some other thesis rattling event, odds are it would stem from the nice to have problem of the share price climbing to such a point that the risk to reward trade-off found in a Thematic Contender is far more compelling.

As for “will you do it?” I think the answer is we just might, I just need to check on a few things and work out a few kinks before committing to it. Those that are interested in knowing more, feel free to email me at customerservice@TematicaResearch.com.

And for those thematic naysayers out there, I’d quickly point out that for the first five months of 2020 the Tematica Research Cleaner Living Index was up 8.1% vs. -5.4% for the S&P 500.

What’s Ahead

Odds are investors will increasingly focus on coming data, both economic and anecdotal, to confirm whether the reopening of the U.S. and other countries is translating into a pick-up in consumer spending and the overall economy. In the coming weeks, odds are we will hear far more details about the economic re-opening, and while I’m cautiously optimistic the realistic truth is we will be hearing about success as well as setbacks and that could rattle equities as hopium inspired expectations are rethought. As it relates to the Thematic Leaders, there may be some EPS fine-tuning that occurs, but with each of our themes, I continue to see the tailwinds blowing.