Why the market might be too far out over its ski tips

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

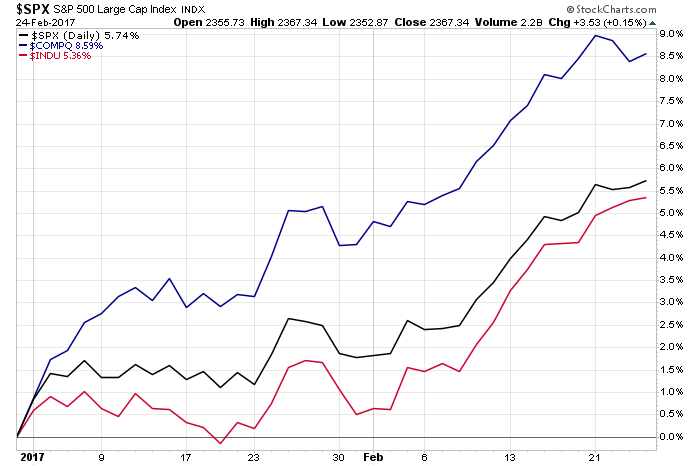

While it looked like the stock market was headed to close on Friday in the red, a late day rally once again put all the major market indices in the green. We point this out because it means the Dow Jones Industrial Average has now booked 11 consecutive days higher, closing at all-time highs in the process. This was the first time that has happened since January 1987.

Year to date, all of the major market indices are up from 5.5 percent to more than 8 percent and that has the S&P 500’s valuation clocking in at 18x 2017 earnings expectations, well above its historical averages and at the highest level since 2004.

As some have said, it looks like the market could be too far out over its ski tips, given that more signs point to the much hoped for pick up in the economy coming at the soonest in the back half of 2017. We’ve been fairly consistent in calling that timing and now we’re thinking the stock market is starting to recognize it as it stares at the disconnect between the market’s valuation and GDP expectations for the first half of 2017.

We’re mindful of the elevated market valuation, as well as the continued impact of the Trump Trade that has continued to boost optimism even though we’ve yet to get full details on a number of his initiatives. With earnings season winding down, we’ve got a crossroads of some improving economic data and other less robust data such as rising auto loan delinquencies, especially on subprime auto loans, rising gas prices that are likely to crimp consumer wallets, and the first baby boomers entering their 70s.

The question we keep pondering is what could the near-term catalyst be that would lead the market lower? Political? Economic? We’ll be sure to ponder this and more over as the current corporate earnings season begins to abate.

Is a March Rate Hike Still on the Table?

Those were some of the topics Tematica’s Chief Investment Officer Chris Versace and Lenore Hawkins, Tematica’s Chief Macro Economist, discussed on last week’s Cocktail Investing podcast. The duo also went on to discuss the renewed wave of M&A activity as well as shared their thought on the Fed’s upcoming FOCM meeting and whether we will see an interest rate hike. As part of that conversation, Versace and Hawkins touched on several pieces of upcoming data that could give the Fed room to boost interest rates, but also noted certain key pieces of upcoming Washington policy that could keep the Fed’s hand off the rate hike button.

Coming into last week, expectations were rather low for March rate hike. Between last week’s capitol hill testimony by Fed Chairwoman Janet Yellen and this week’s latest iteration of the Fed FOMC minutes for its late January meeting and next week’s end of the month, start of the new month data deluge, we thought it best to rehash recent Fed-related events in chronological order to put some perspective on things.

The Fed’s last meeting was held in late January and as we said above, this week we received the minutes of that meeting. Coming out of that report much of the media hung their hats on the following statement:

“Many participants expressed the view that it might be appropriate to raise the federal funds rate again fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations.”

We found this one in the FOMC minutes far more telling:

“Participants discussed whether their current assessments of economic conditions and the medium-term outlook warranted altering their earlier views of the appropriate path for the target range for the federal funds rate. Participants generally characterized their economic forecasts and their judgments about monetary policy as little changed since the December meeting.”

Again, we’re looking at this in chronological order, which means we turn to Fed Chairwoman Yellen’s recent testimony. In that briefing, Yellen confirmed the notion the Fed would seek to boost rates up to three times in 2017 but also cautioned the Fed needs to see the economic stimulus and tax overhaul plans that are pending from President Trump to determine the potential impact on the economy and inflationary forces.

Last week, we received some favorable economic data in the February Flash PMIs published by Markit Economics, and a solid Existing Home Sales figure for January. Looking into the Existing Home sale report, while the figure was the strongest since February 2007, our key takeaway is that high prices and limited inventory continue to compress the affordability factor for potential buyers, thereby capping the market. Across the Flash PMIs, we saw solid economic growth, but we also saw rising input prices – something the Fed is bound to be watching.

Speaking of the timing of his tax plan late this week, President Trump stated, the tax reform plan was “well finalized”, but will only be released after a successful repeal of the Affordable Care Act. Then last Thursday Treasury Secretary Steven Mnuchin said he expects a plan to pass through Congress before the August recess.

To us, this means in all likelihood the Fed will not have time to digest and assess the plan ahead of the March meeting, which puts the next rate hike potentially in May. Our view on this was confirmed by the quick sell-off in the PowerShares DB US Dollar Index Bullish (UUP) soon after the Fed minutes were published.

Looking to the Week Ahead

We’ve got the usual end-of-month and start-of-the-new-month data to contend with as we flip the calendar to the month of March. That means the January Durable Orders and Personal Income & Spending Report as well as the final Markit PMI data, ISM reports on both the manufacturing and services economy and of course a few looks at February job creation.

Normally, we’d be paying loose attention to that data as a matter of course, but given recent snapshots of the economy, these reports will no doubt be put under the microscope, especially by those that think the Fed might move in March.

Again, we see a low probability of that happening.

A Thematic Perspective on Earnings this Week

While we’re easing off the gas pedal a bit this week on the earnings front, there are still more than 50 announcements we’re going to keep an eye on this week for specific thematic data points. Our Cash-strapped Consumer and Fattening the Consumer investing themes take center stage this week. With Nordstrom’s (JWN) earnings buoyed by its off-price Nordstrom Rack as well as Costco’s (COST) robust January same-store-sales, the probability is companies like Costco, Ross Stores (ROST) and Big Lots (LOTS) are likely to outshine their department store step sisters. We were reminded of the department store pain once again when JC Penney (JCP) announced late last week it will be closing 130 to 140 stores and offer buyouts to 6,000 workers.

This is but the latest of such news given that several weeks back Macy’s (M) announced plans to cut 100 of its 675 full-line stores. JCP’s action is the latest confirmation for the continued Connected Society headwind that brick & mortar retailers, as well as mall operators like Simon Property Group (SPG), are facing. This accelerating shift to digital commerce has been a key driver in the better than 14 percent move in the Amplify Online Retail ETF (IBUY) and with both consumers and retailers embracing online and mobile platforms, the outlook for IBUY shares remains rather favorable.

With regard to our Fattening of the Consumer investing theme, there is a litany of quick service restaurants reporting this week including Shake Shack (SHAK), Habit Restaurants (HABT) and Domino’s (DPZ). While Versace enjoys his burgers, including those at Shake Shack and Habit, falling restaurant industry traffic and the impact of rising minimum wages offers a less than compelling outlook. As we talked about on last week’s Cocktail Investing podcast, when McDonald’s (MCD) opts to cut the prices of its margin rich drinks to spur traffic, odds are all is not well within the industry. We’d note the Restaurant ETF (BITE) shut down in late 2016, and given our comments, we’d suggest investor steer clear of USCF Restaurant Leaders Fund (MENU) that counts a number of quick-service and fast casual restaurant companies among its holdings.

While the above set of companies are ones that tend to help with the expansion of our Fattening of the Consumer theme, we also have the other side with companies such as Weight Watchers (WTW), NutriSystem (NTRI) and Insulet Corp. (PODD) reporting quarterly results this week. Buried inside all of these we will also hear from Kroger (KR), and given our Foods with Integrity investing theme, we’ll be looking to see if the pace at which Kroger has been expanding into organic, natural and other healthy offerings remains brisk. Looking back on Whole Foods Market (WFM) and its resizing new store opening targets, we continue to see that move due more to the increasing Food with Integrity offering at mainstream grocers, such as Kroger, Ralph’s, Safeway, Wegman’s and others that are dedicating more and more shelf space to organic, natural, gluten-free and other similar products.

Thematic Data Points Come from More Than Just Earnings Reports

We have a number of other companies across our various investing themes reporting this week, and as usual, a more detailed list can be found at the end of this report. As the pace of corporate earnings starts to subside and with one month until we close the current quarter, we have a number of investment conferences this week, which are bound to offer some data points and potentially share price movement.

Here are some of the meetings and conferences that we’ll be looking to see the news flow from this week:

- Morgan Stanley Technology, Media and Telecom Conference:

A number of our Connected Society and Content is King companies will be attending, and conference comments are likely to impact ETFs such as Technology Select Sector SPDR Fund (XLK) and First Trust Dow Jones Internet Index Fund (FDN). - Mobile World Congress:

This is one of the largest mobile events of the year, which means a flurry of announcements and product debuts. We expect much activity as it relates to our Connected Society and Disruptive Technology investing themes. - Game Developers Conference (GDC) 2017:

While most tend to think of film, TV and music when it comes to our Content is King theme, gaming is not to be underestimated. We’ll be looking for news on the latest titles and platforms, including comments that might suggest the industry is moving deeper into mobile and online gaming that is likely to hit GameStop (GME). - Keefe, Bruyette and Woods (KBW) Cards, Payments & Financial Technology Symposium:

With presentations for Visa (V), MasterCard (MA) and American Express (AXP), our Cashless Consumption ears will be burning this week. - Credit Suisse 2017 Global Healthcare Conference:

We’ll be listening in given our Aging of the Population investing theme, as should holders of iShares Dow Jones US Healthcare ETF (IYH) and Vanguard Health Care ETF (VHT). - UBS Utilities and Natural Gas One-on-One Conference:

While this could be one of the quieter conferences, holders of Utilities SPDR ETF (XLU) and iShares Dow Jones US Utilities ETF (IDU) should keep their ears open.

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- Sotheby’s (BID)

- Steve Madden (SHOO)

Aging of the Population

- Senior Housing (SNH)

- Tactile Systems Technology (TCMD)

- Tenet Health (THC)

Asset Lite Business Models

- Hertz Global Holdings (HTZ)

- Workday Inc. (WDAY)

Cash-strapped Consumer

- Autozone (AZO)

- Big Lots (BIG)

- Burlington Stores (BURL)

- Costco Wholesale (COST)

- Maiden Holdings (MHLD)

- Perrigo (PRGO)

- Ross Stores (ROST)

- Sears (SHLD)

Connected Society

- Ambarella (AMBA)

- Broadcom (AVGO)

- Best Buy (BBY)

- Priceline (PCLN)

Content is King

- AMC Entertainment (AMC)

- Gray Television (GRAY)

Disruptive Business Models

- 3D Systems (DDD)

- Immersion (IMMR)

Economic Acceleration/Deceleration

- FreightCar America (RAIL)

- US Concrete (USCR)

Fattening of the Population

- Domino’s Pizza (DPZ)

- DineEquity (DIN)

- Fiesta Restaurants (FRGI)

- Habit Restaurants (HABT)

- Ignite Restaurants (IRG)

- Insulet Corp. (PODD)

- Kona Grill (KONA)

- Kroger (KR)

- Nutrisystem (NTRI)

- Shake Shack (SHAK)

- Weight Watchers (WTW)

Foods with Integrity

- Inventure Foods (SNAK)

Fountain of Youth

- Omega Protein (OME)

- Planet Fitness (PLNT)

- Vitamin Shoppe (VSI)

Guilty Pleasure

- Anheuser-Busch InBev (BUD)

- Churchill Downs (CHDN)

Rise & Fall of the Middle Class

- Armstrong World (AWI)

- Dillard’s (DDS)

- Lowe’s (LOW)

Safety & Security

- American Outdoor Brands (AOBC)

- Palo Alto Networks (PAWN)

- Taser (TASR)

Scarce Resources

- Global Water Resources (GWRS)

- Itron (ITRI)

Tooling & Re-tooling

- American Public Education (APEI)

- Barnes & Noble Education (BNED)

- Lincoln Education Services (LINC)