Why we find the supposedly “data dependent” Fed’s action last week rather interesting

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

We here at Tematica hoped you enjoyed yourself on St. Patrick’s Day as we put the remnants of winter storm Stella into our rearview mirror. That celebration of Irish pride capped off a rather busy week that began with several economic reports, including February Retail Sales and inflation metrics, before getting to the big item of the week, the Fed’s March FOMC meeting at which it, as widely expected, boosted interest rates. What wasn’t quite so expected was the Fed’s dovish outlook, which was reinforced by its largely unchanged economic forecast that calls for GDP growth of 1.9-2.3 percent between now and 2019.

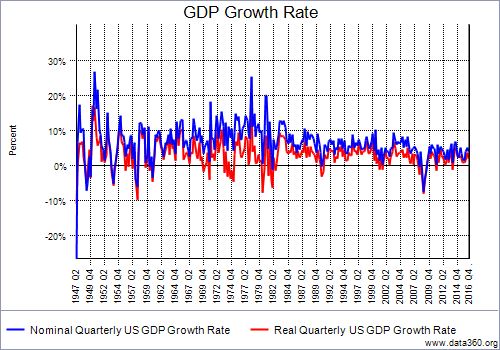

If that forecast comes to fruition, according to Tematica’s Chief Marco Strategist Lenore Hawkins, it would mean a 14-year stretch where annualized GDP did not surpass 3 percent — that’s never happened, not even during the Great Depression!

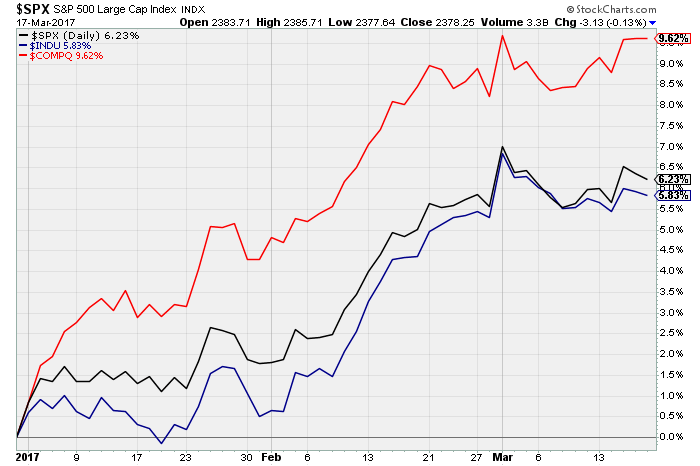

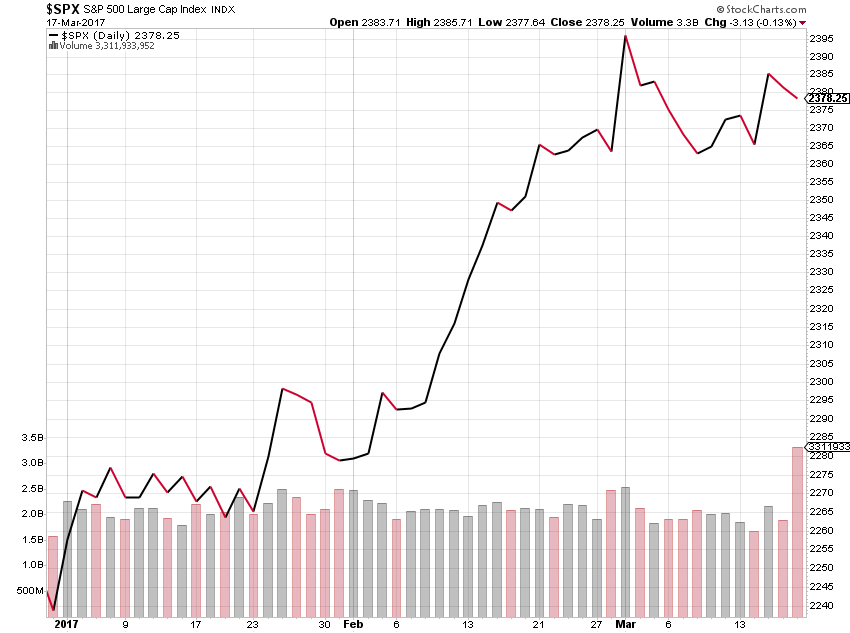

Even so, the stock market rallied on the Fed’s rate hike before trading off later in the week. Exiting last week, the S&P 500’s year to date return hit 6.2 percent with the index trading at 18.0x expected 2017 earnings. Pretty much, still out over its ski tips when we consider the Fed’s comments and the hard data that shows the domestic economy is once again slowing.

Why we find the supposedly “data dependent” Fed’s action last week rather interesting

Given the Fed’s rather lousy track record when it comes to timing its rate increases — more often than not, it tends to raise interest rates at the wrong time. This time around, however, it seems the Fed is somewhat hellbent on getting interest rates back to normalized levels from the artificially low levels they’ve been at for nearly a decade. Even the language with which they announced the rate hike — “In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent.”

Ha-hem! We didn’t realize that expected data was enough to move the Fed and recent economic data hasn’t been all that robust. Last week, the Fed’s own Atlanta Fed once again slashed its GDPNow forecast for 1Q 2016 yesterday to 0.9 percent from 1.2 percent last week and more than 3.0 percent in January.

That’s a big downtick from 1.9 percent GDP in 4Q 2016!

Cue the dramatic sound effect!

Given the impact of winter storm Stella, particularly in the Northeast corridor, odds are GDP expectations will once again tick lower as consumer spending and brick & mortar retail sales, as well as restaurant sales, were both disrupted.

Despite that lack of wage growth as evidenced by real average hourly earnings in February, we have seen inflation pick up over the last several months inside the Purchasing Managers’ Indices published by Markit Economics and ISM for both the manufacturing and services economies as well as the Producer Price Index. Year over year in February, the Producer Price Index hit 2.2 percent, marking the largest 12-month increase since March 2012.

Turning to the Consumer Price Index, the headline figure rose 2.7 percent this past February compared to a year ago, making it the 15th consecutive month the 12-month change for core CPI was between 2.1 percent and 2.3 percent. We’ve all witnessed the rise in gas prices, up some 18 percent compared to this time last year, and while there are adjustments to strip out food and energy from these inflation metrics, our view is food and energy are costs that both businesses and individuals must bear. Rising prices for those items impact ones ability to spend, especially if wages are not growing in tandem.

That said, oil prices to date in March, as measured by West Texas Intermediate Prices, have fallen 10 percent since the end of February and bode well for some relief at the gas pump. With new Disruptive Technologies helping to make fracking and drilling more efficient, thus lowering the breakeven price, we’ve seen a growing number of US rigs back online, which has offset the OPEC productions cuts. With President Donald Trump pushing for deregulation in the fossil fuel industry, we could see even more US rigs coming back on stream in the coming quarters, which likely means oil prices peaked in early January.

Getting back to the Fed, it would seem Janet Yellen and crew are caught once again between a rock and a hard place — the economy is slowing, at least for the near-term, and inflation appears to be on the move. The economic term for such an environment is stagflation. The Fed is walking a thin line between trying to get a handle on inflation, while not throwing cold water on the economy as it continues to target two more rate hikes this year. We suspect that their move towards more normalized rates is driven in part by a desire to have some firepower at the ready in case of an economic downturn. Yep, Yellen’s job is not one we would want.

The lowdown on February Retail Sales

Moving past the Fed and interest rates, we also received the February Retail Sales report last week. Month over month retail sales climbed by 0.1 percent, in line with expectations. The four categories that saw faster spending growth than the average were furniture (+0.7 percent), building materials (+1.8 percent), health & personal care stores (+0.7 percent) and nonstore retailers (+1.2 percent). The sequential increase in building material demand, as well as furniture, fits with the mild winter weather that led to a pickup in construction employment and a stronger than seasonal pickup in housing starts.

The continued tick higher in health & personal care stores ties with our Aging of the Population investing theme. We continue to see this category rising faster than overall retail spending as the first baby boomers turn 70 this year with another 1.5 million joining them each year for the next 15 years. The scary part is of these baby boomers, roughly only 50 percent have saved enough for retirement, which touches on our Cash Strapped Consumer investing theme in addition to the obvious Aging of the Population theme.

Finally, we once again see Nonstore retailers taking consumer wallet share in February, which comes as no surprise as Amazon (AMZN) and other retailers continue to expand their service offerings and geographic footprints, while other traditional brick & mortar retailers focus on growing their direct to consumer business. In short, our Connected Society investing theme continues to transform retail.

Viewing the February Retail Sales Report data on a year over year basis, those sales excluding autos and food rose 5.9 percent led by a 19.6 percent increase in gasoline station sales, a 13.0 percent increase in Nonstore retail, a 7.3 percent rise in building materials, a 7.0 percent increase at health & personal care stores. Without question, the rise in gasoline station sales reflects the year over year 18 percent increase in gas prices per AAA data, while the milder winter we discussed earlier is likely pulling demand forward in construction and housing — we’ll look for February, March and April housing data to confirm this. The rise in gas prices reflects OPEC oil production cuts, which serves as a reminder that oil and other energy products are part of our Scarce Resource investing theme as there is only so much to be had, and production levels dictate supply. But as we discussed several paragraphs above, there are factors that can improve yields on even scarce fossil fuels.

As far as the year over year increase in health & personal care goes, it’s the same story — the Aging of the Population as Father Time is a tough customer to beat no matter how people embrace our Fountain of Youth investing theme. Finally, and certainly no surprise, is the continued increase in Nonstore retail sales. Candidly, we see no slowdown in this Connected Society shift — all we need to do is look at the evolving shopping habits of the “younger” generation.

The two big declines on a year over year basis in February were electronic & appliance stores, which fell 6 percent year over year, and department stores, which dropped 5.6 percent. With hhgregg (HGG) closing a good portion of its stores and JC Penney (JCP) recently announcing even more store closures, the results of these two categories, which are likely feeling the heat from Amazon (AMZN) in particular and others benefiting from the Connected Society tailwind, the results from these two categories is anything but surprising.

If we look at the three month rolling average on both a sequential and year over year basis, the leaders remained the same — building materials, gasoline stations, Nonstore retail and health & personal care. Behind each of these there is a clear thematic tailwind, even construction and housing, which has historically been a beneficiary of the rising aspect of our Rise & Fall of the Middle Class investing theme.

And just in case anyone was holding out hope for electronics & appliance stores and department stores, the three-month rolling averages showed continued declines on both on a sequential and year over year basis. Nothing like a thematic headwind to throw cold water on your business.

The question to us is whether we will see more M&A chatter like we saw several weeks back with Macy’s (M) and more recently with Hudson Bay (HBC) being interested in Neiman Marcus. We can understand one company picking off well-positioned assets that might improve its overall customer mix, but we suspect there will be a number of companies left standing with no dance partners when this game of retail musical chairs is over. That means more companies going the way of Wet Seal than not, which means pain for mall REIT companies like Simon Property Group (SPG).

As we scrutinize the February Retail Sales report, we have to mention something Lenore wrote last week that called out the lack of weekly, year over year wage growth in February. Rising prices, as evidenced by the year over year increase in gasoline retail sales, with tepid wage growth tells us our Cash-strapped Consumer investing theme has more room to go. As we shared recently with subscribers to Tematica Investing, consumer credit card levels are nearing 2007 levels and higher interest rates mean less disposable income is likely to be had. We see that as another headwind for GDP growth in the near-term, and yet another reason to think that before too long the current mismatch between hard economic data and the stock market is likely to be reconciled.

The Week Ahead

Turning our gaze to the coming week, once it closes we’ll have all of 10 trading days left in the current quarter, and yes that means that soon we will once again be hip deep corporate earnings reports. The economic data deluge that we had this week will slow considerably with less than a handful of data points that include the Chicago Fed’s National Activity Index February’s New and Existing Home sales as well as Durable Orders for the month. Mixed in an around those releases, there is no shortage of Fed heads giving speeches and talk this week. All in all, we count more than 10 such presentations. Exiting the week, we’ll get the March Flash PMI metrics from Market Economics for the US, Japan and Eurozone, which should help color in the lines of global 1Q 2017 GDP.

Looking past the coming economic data, we’ll be starting the week off with weekend box office data that should tell us how Content is King company Disney’s (DIS) live action Beauty and the Beast film fared on opening weekend. We’ll also be assessing the outcome of the weekend’s G20 summit of finance ministers and central bank governors. Sounds like an exciting time doesn’t it?

Yes, that was sarcasm.

As the week progresses, we’ll get a number of thematic contenders reporting quarterly earnings including Rise & Fall of the Middle Class company Nike (NKE), Asset-Lite Business Model company PVH (PVH), and Affordable Luxury players Movado Group (MOV) and Restoration Hardware (RH). We’ll also hear from GameStop (GME) a Content is King company that is hitting the Connected Society headwind as gamers increasingly opt for streaming and downloadable games, not ones on DVD or some other dated modality.

With two weeks to go until the end of the quarter, investors will be looking for earnings clues from yet another round of investor conferences that include:

- The 2017 Consumer Analyst Group Europe Conference, which showcases a number of European-based companies including Givaudan SA (GVDNY), Diageo (DEO), WPP (WPPGY), International Flavors & Fragrances (IFF), and Unilever (UN). ETFs that could see some movement following the conference include the Dow Jones Europe Consumer Goods Index (E1NCY) and S&P EUROPE 350 – Consumer Discretionary (SPE350-25)

- The Morgan Stanley Financials Conference that features Morgan Stanley (MS), Credit Suisse (CS), Worldly Group (WPYGY), and Banco Bilbao Vizcaya Argentaria SA (BBVA) among others. The ETF to gauge investor reactions to these presentations would be

- There are two healthcare conferences — Oppenheimer’a 27th Annual Healthcare Conference 2017 and the SunTrust Robinson Humphrey Healthcare IT Summit – which mean watching iShares Dow Jones US Healthcare (IYH) shares as a gauge of investor reception to those presentations.

- The Bank of America Merrill Lynch Global Industrials Conference, which features companies like Eaton (ETN), Parker Hannifin (PH), Dover (DOV), United Rentals (URI) and Ingersoll Rand (IR). For those investors looking for industrial ETFs to monitor we would suggest both The Industrial Select Sector SPDR Fund (XLI) and iShares Dow Jones US Industrial ETF (IYJ).

As we mentioned at the start of this edition of the Monday Morning Kickoff, the S&P 500 is trading at 18.0x forecasted 2017 earnings per share. Backing into corporate profit outlook by looking at payroll and wage data combined with output and pricing numbers, it looks like we will see a flattening of profits in this quarter. Net margins for the S&P 500 group of companies have been trending lower over the last several quarters and if they flatten as the data suggests, it means it will be rather challenging for S&P 500 earnings to meet expectations calling for just over 10 percent growth this year.

The bottom line is the market’s valuation is stretched at a time when expectations for both the economy and earnings need to be dialed back. Perhaps it’s time to take heed from corporate insiders, which have slowed buyback programs and according to Vickers Weekly Insider chief executives and other corporate insiders are selling stock “hand over fist now that the quarterly earnings season is over.” It seems to us the probability of a market pullback in the coming weeks continues to move higher.

In our view, it’s time for investors that have enjoyed the strong move in the stock market over the November to February time frame to be cautious.

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- Movado Group (MOV)

Restoration Hardware (RH)

Asset-lite Business Models

- Accenture (ACN)

- PVH (PVH)

Cash-strapped Consumer

- Five Below (GIVE)

Connected Society

- Sigman Designs (SIGM)

- Content is King

- GameStop (GME)

Economic Acceleration/Deceleration

- FedEx (FDX)

Fattening of the Population

- ConAgra (CAG)

- General Mills (GIS)

Rise & Fall of the Middle Class

- Finish Line (FINL)

- KB Home (KBH)

- Land’s End (LE)

- Lennar (LEN)

- Nike (NKE)

Tooling & Retooling

- Scholastic Corp. (SCHL)