With the Inauguration Behind Us, Earnings and Trump Policies Are The Focus

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

If you tuned into any media on Friday, let alone any of the financial cable news networks, you probably saw little in the way of stock and market news in favor of the inaugural proceedings for now President Donald Trump. We’ll steer away from sharing what we thought about the day’s events in DC as well as those over the weekend, preferring to stick to our knitting that is thematic investing.

A housekeeping item before we get to the usual Monday Morning Kickoff business

We are rather excited to attend the Inside ETF Conference this week in far warmer Hollywood, Florida, in part because we know ETFs account for a growing part of the investors’ appetite, but also the opportunity to share our thematic perspective as well as the thematic indices that we’ve been noodling on. We hope to report back soon with some favorable developments.

Now let’s get down to business…

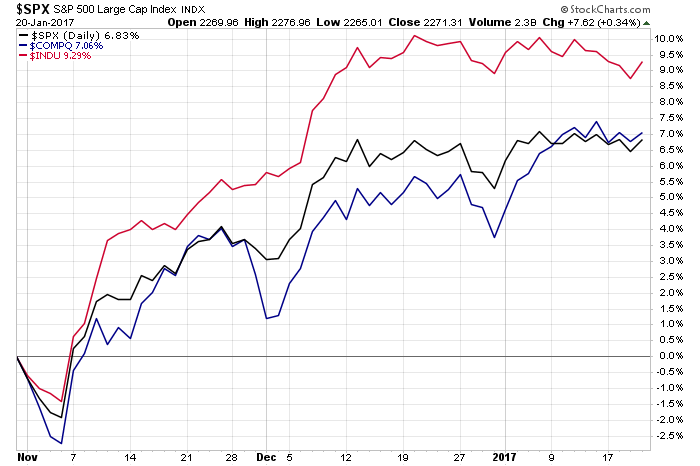

Remembering that last week was a shortened one due to the Martin Luther King holiday, for the four trading days that we had, all three major market indices dipped modestly compared to the prior week. Even though we are not sector focused, it was not lost on us that generally speaking “growth” stocks took a back seat to dividend payers last week. Hardly surprising when we reflect on the mixed bag that we’ve seen thus far in corporate earnings for the December quarter as well as looming issues in the Eurozone and political policy questions here in the US.

Against that backdrop, leave it to Janet Yellen to muddy the waters even further by saying, “I think that allowing the economy to run markedly and persistently ‘’hot’’ would be risky and unwise,’’ at the Stanford Institute for Economic Policy Research last week. In a vacuum, we would agree with Yellen, but she and others think the current economic climate is anything close to “hot,” well then, we have to wonder exactly what plane of reality she is living in.

We suspect Yellen is likely paving the way for the three potential rate hikes that were made known following the Fed’s December rate hike, but given her dovish nature, we think under the bluster she and the Fed will remain data dependent. We would, of course, recommend the Fed expand its prime data set beyond the unemployment rate, which to us is as solid as Swiss cheese.

Janet Yellen wasn’t the only one to make headlines last week. European Central Bank head Mario Draghi shared his view of a gradual economic recovery in the Eurozone that still requires “very substantial” support. The ECB is not likely to wind down its stimulus until inflation “had increased in a sustainable way” Draghi said, and stripping out the impact of higher oil prices that has yet to emerge.

Most economists expect the ECB to wait until the summer to signal an end to its monetary stimulus efforts, after Dutch and French elections, and as the direction of U.S. economic policy becomes clearer. Amid growing anti-Euro sentiment in the form of Brexit becoming a reality and concerns over “Italeave” and “Frexit” as well as another round of Greek drama, investors are likely to head into more risk-averse currencies like the dollar as well as US stocks.

Against that Economic Backdrop,

Has the Trump Trade Rally Peaked?

With the S&P 500 trading at more than 19 times 2016 earnings and 17 times expected 2017 earnings — the delta between those two P/E multiples is the expectation of 12 percent earnings growth in 2017; rather large given the current speed of the economy, but more on that down below — we’d say the market is priced to perfection at current levels.

This means any disruption or outcome that is less than expected is likely to weigh on the market. Not a bad thing, as in our view, it offers the chance to place well-positioned companies riding thematic tailwinds on the Tematica Select List at better prices.

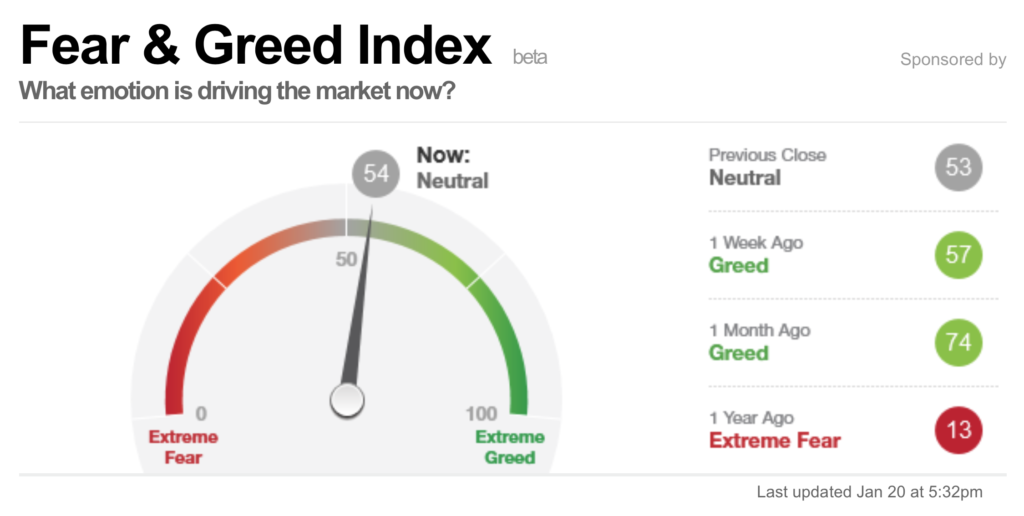

Interestingly enough, according to data published by Alpha Hat, the stock market usually tumbles in the year after a Republican president is sworn in. The median S&P 500 performance for both parties one year after inauguration is 7.6 percent with -7 percent for Republican presidents, and 14.7 percent for Democratic presidents. Again, those are averages, but it does help explain the recent pullback in the CNN Money Fear & Greed Index to a “neutral” reading compared to “greed” just one month ago.

Corroborating this neutral view, the January Fund Manager Survey by The Bank of America Merrill Lynch found that even though investors are geared up for stronger growth and inflation, they are still reluctant to put cash to work. When asked what they perceive as the biggest tail risks to markets, responding fund managers cited trade war/protectionism (29 percent), U.S. policy error (24 percent) and China FX devaluation (15 percent). In our view, the market is likely to remain trapped in its current trading range until we have greater clarity on these three major issues just mentioned.

Corroborating this neutral view, the January Fund Manager Survey by The Bank of America Merrill Lynch found that even though investors are geared up for stronger growth and inflation, they are still reluctant to put cash to work. When asked what they perceive as the biggest tail risks to markets, responding fund managers cited trade war/protectionism (29 percent), U.S. policy error (24 percent) and China FX devaluation (15 percent). In our view, the market is likely to remain trapped in its current trading range until we have greater clarity on these three major issues just mentioned.

As far as the Eurozone drama and pending political policies to be put in motion by the new Trump administration, we’ll continue to monitor developments over some of the more telegraphed items. Last week economist Stephen Moore was discussing the likelihood that the Trump camp would propose two tax overhauls — one for personal income taxes and one for corporate. In our view, this is a smart move given that lower corporate taxes are likely to be an incentive for attracting companies and therefore jobs to the US, a key item for Team Trump, without getting bogged down in what is likely to be a dogfight over personal income tax rates. Hopefully, Team Trump will be as pragmatic with other solutions it looks to put forth in the coming weeks; if that’s the case it would likely be a tonic for the uncertainty currently sitting in the stock market’s stomach.

Turning to the week ahead

While we’ll be in Florida at the Inside ETF Conference, it will be a full week of earnings and economic data that ends with the start of the Chinese New Year. As Barron’s reports, “It’s the Year of the Rooster; an aggressive, combative, and argumentative bird, and Hong Kong seers say that bodes well for the new US president, who has been known to exhibit the same characteristics.” Here’s hoping that fortune is a right as the last one we got in our fortune cookies.

This week the earnings outlook picture should get a wee bit clearer as we have more than 500 companies reporting earnings this week. Of that 500, 70 S&P 500 companies (including 12 Dow 30 components) are scheduled to report results for the fourth quarter. This means that at the end of the week, just over 25 percent of the S&P 500 companies will have issued their earnings and guidance. Again, that should shed some light on the earnings picture, but it’s not quite enough to get a real clear tell on how aggressive the current consensus expectation is for 12 percent earnings growth for the S&P 500 in 2017 over 2016.

On the Economic Front

There will be a handful or reports, including the latest existing and new home sales reports as well as the same for durable orders. The big report next week, though, will be the initial fourth-quarter 2016 GDP numbers. While the expectation is GDP will slip relative to 3.5 percent in 3Q 2016, expectations for 4Q are fairly widespread, between 1.9 percent (N.Y. Federal Reserve) to 2.9 percent (Atlanta Fed GDP Now). Odds are the Wall Street Journal’s Economic Forecast Survey, which calls for 2.1 percent, will be more in line with reality.

On top of the recent mixed earnings bag we’ve received already this December quarter earnings season, that calls into question the ability of the S&P 500 companies to deliver 12 percent earnings growth this year. While we don’t see a repeat of the constant negative earnings revisions we saw in 2016, odds are expectations for 2017 will need to be adjusted lower given the likelihood GDP growth in the range of 2.2 to 2.4 percent will be with us in the first half of 2017.

Now, Turning to Earnings

A few paragraphs above we mentioned that roughly 14 percent of the S&P 500 is reporting this week. Realizing that means we have roughly 75 percent of the S&P 500 yet to report, we’ll take our cue from the earnings data points and insights that will emerge from 13 of our 17 investment themes this week. A more detailed listing can be found further on, but some of the more notable ones will be Connected Society companies AT&T (T) and Verizon (VZ); Asset-Lite Business Model players Alphabet (GOOGL) and Qualcomm (QCOM); Cashless Consumption company PayPal (PYPL); Disruptive Technology company Synaptics (SYNA); and Safety and Security companies Lockheed Martin (LMT), Northrop Grumman (NOC) and ProofPoint (PFPT). Given the state of US infrastructure and the Trump position that it needs to be fixed, overhauled and updated, we’ll also be paying close attention the respective outlooks to be had from Economic Acceleration/Deceleration companies Caterpillar (CAT) and United Rentals (URI) this week.

Our 10,000-foot view on earnings

Over the last few years, we’ve seen earnings season become a greater source of stock price volatility — miss EPS expectations by a penny, and we now see share prices fall 10 to 20 percent, far greater than the single-digit selloffs that had been the norm several years ago. Granted these tend to be short-term disruptions that eventually give way to fundamentals, but that usually takes some time for the dust and yo-yoing stock prices to settle down.

With this in mind, we’re holding off making any new moves when it comes to the Tematica Select List as we instead digest company comments regarding the tone of the economy, impact of the dollar on their business outlook and of course their ability to further capitalize on still blowing thematic tailwinds.

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- Arctic Cat (ACAT)

- Royal Caribbean (RCL)

Aging of the Population

- Bristol-Myers (BMY)

- Johnson & Johnson (JNJ)

- Petmed Express (PETS)

- Abbott Labs (ABT)

- Cardiovascular Systems (CSII)

Asset-lite Business Models

- Alphabet (GOOGL)

- Dolby Labs (DLB)

- Qualcomm (QCOM)

Cashless Consumption

- Discover Financial Services (DFS)

- PayPal (PYPL)

Cash-strapped Consumer

- McCormick & Co. (MKC)

- eBay (EBAY)

Connected Society

- AT&T (T)

- Citrix Systems (CTXS)

- Comcast (CMCSA)

- Ericsson (ERIC)

- Intel (INTC)

- Yahoo! (YHOO)

- Verizon (VZ)

Disruptive Technology

- Cree (CREE)

- Synaptics (SYNA)

- II-VI (IIVI)

- InvenSense (INVN)

Economic Acceleration/Deceleration

- 3M (MMM)

- Caterpillar (CAT)

- Honeywell (HON)

- Norfolk Southern (NSC)

- United Rentals (URI)

- WW Grainger (GWW)

Fattening of the Population

- Brinker (EAT)

- J & J Snack Foods (JJSF)

- McDonald’s (MCD)

Guilty Pleasure

- Las Vegas Sands (LVS)

- Starbucks (SBUX)

Rise & Fall of the Middle Class

- American Airlines (AAL)

- Colgate-Palmolive (CL)

- DR. Horton (DHI)

- Ethan Allen (ETH)

- Fiat Chrysler (FCAU)

- Ford Motor (F)

- JetBlue Airways (JBLU)

- Mead Johnson Nutrition (MJN)

- Regis Corp. (RGS)

- Sherwin Williams (SHW)

- Southwest Air (LUV)

- Whirlpool (WHR)

Safety & Security

- General Dynamics (GD)

- F5 Networks (FFIV)

- Lockheed Martin (LMT)

- Northrop Grumman (NOC)

- Oshkosh (OSK)

- ProofPoint (PFPT)

- United Technologies (UTX)

Scare Resources

- Chevron (CVX)

- Potash (POT)

Tooling & Retooling

- K12 (LRN)

- Robert Half (RHI)